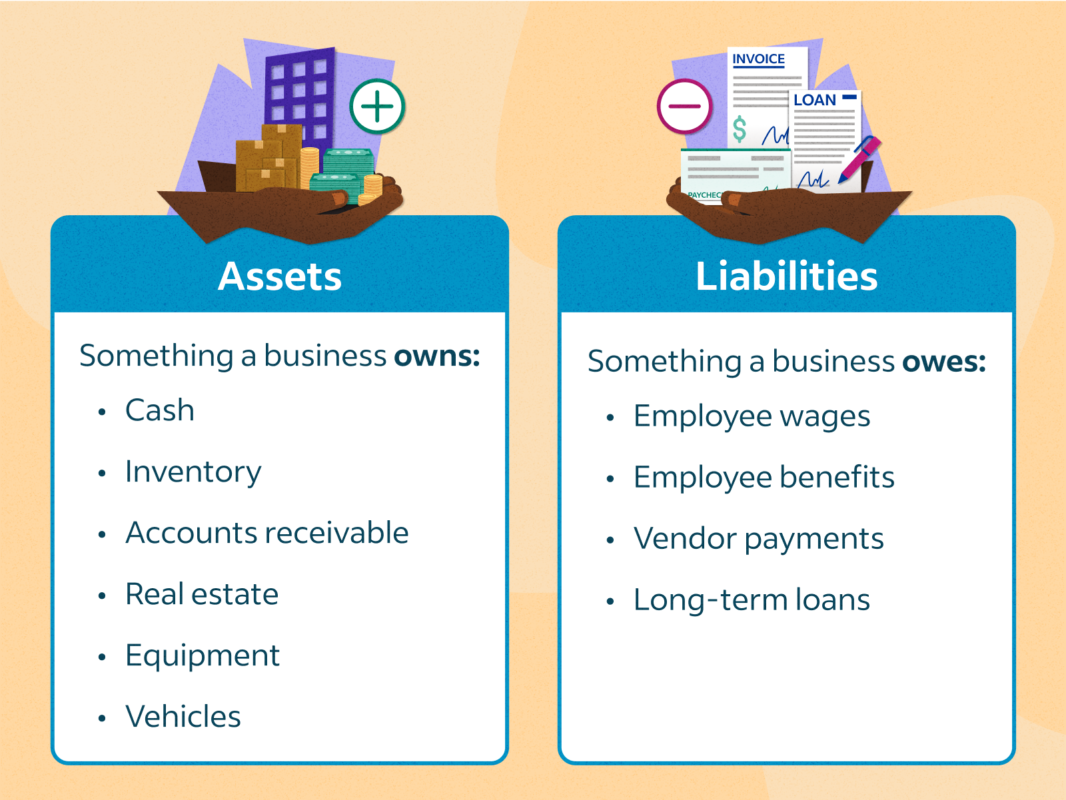

Assets are things that a person, company, or government owns or controls, while liabilities are things that are owed to another person, company, or government. Assets are resources that have the potential to generate economic benefits in the future, such as income or holding value. Liabilities are financial obligations or debts that need to be settled, which may involve giving up resources or services. The balance between assets and liabilities can affect a company’s profit and liquidity. For example, a healthy balance can help with making financial decisions, preparing for the future, and achieving financial goals. However, high levels of liabilities can restrict financial flexibility because a large portion of cash flow may need to be used to repay debt.

Difference between Assets and Liabilities

Assets and liabilities are fundamental concepts in accounting and finance, representing what a company or individual owns and owes, respectively.

Assets and Liabilities

Assets

Assets are resources owned by an individual or a company that are expected to provide future economic benefits. They are things of value that can generate revenue or can be converted into cash.

Types of Assets:

- Current Assets: These are assets that are expected to be converted into cash or used up within a year. Examples include:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Short-term investments

- Non-Current Assets (or Fixed Assets): These are long-term investments or resources that a company intends to hold for more than a year. Examples include:

- Property, plant, and equipment (PP&E)

- Long-term investments

- Intangible assets (e.g., patents, trademarks)

- Goodwill

Liabilities

Liabilities are obligations or debts that a company or individual owes to others. They represent claims against the company’s assets and are typically settled over time through the transfer of money, goods, or services.

Types of Liabilities:

- Current Liabilities: These are obligations that are due to be settled within a year. Examples include:

- Accounts payable

- Short-term loans

- Wages payable

- Taxes payable

- Non-Current Liabilities (or Long-Term Liabilities): These are obligations that are due beyond a year. Examples include:

- Long-term debt (e.g., bonds, mortgages)

- Deferred tax liabilities

- Pension obligations

Relationship Between Assets and Liabilities

The difference between a company’s assets and liabilities is known as equity or net worth. The basic accounting equation is:

Assets=Liabilities+Equitytext{Assets} = text{Liabilities} + text{Equity}Assets=Liabilities+Equity

This equation shows that a company’s assets are financed either through debt (liabilities) or through the owners’ contributions (equity).

Understanding assets and liabilities is crucial for assessing the financial health of a business or individual.